Common Dreams

In last night's State of the Union speech President Obama announced the creation of a committee to investigate "the abusive lending and packaging of risky mortgages."

All across the US, Occupy protestors have been "reclaiming" foreclosed homes and boarded up properties in what some are calling a "tactical shift" in the movement which has targeted the inequality in the distribution of wealth in the US. The 'investigation' announcement came just as a bank-friendly 'settlement' is about to be announced by the state attorney generals. Reports of the settlement talks, the 'too-big-to-fail' banks -- Bank of America, Wells Fargo & Co, JPMorgan Chase & Co, Citigroup and Ally Financial Inc -- would provide $20 billion to $25 billion of 'relief' to homeowners in exchange for being exempted from lawsuits for improper foreclosures and abuses in mortgage loans.

All across the US, Occupy protestors have been "reclaiming" foreclosed homes and boarded up properties in what some are calling a "tactical shift" in the movement which has targeted the inequality in the distribution of wealth in the US. The 'investigation' announcement came just as a bank-friendly 'settlement' is about to be announced by the state attorney generals. Reports of the settlement talks, the 'too-big-to-fail' banks -- Bank of America, Wells Fargo & Co, JPMorgan Chase & Co, Citigroup and Ally Financial Inc -- would provide $20 billion to $25 billion of 'relief' to homeowners in exchange for being exempted from lawsuits for improper foreclosures and abuses in mortgage loans.

The findings of the new 'investigation' would come after the settlement gives the banks a get-out-of-jail-free card.

Matt Taibbi wrote on the proposed settlement: "The current proposed deal is a huge giveaway to the banks, a major shafting to most of the investors, and would probably give homeowners either next to nothing or some cosmetic reward, i.e. a little bit of principal forgiveness, counseling, etc. If the Obama administration was serious about helping actual human beings through this settlement, then it would be fighting for homeowners to get the same bailout the banks would get. If the banks are getting a trillion or more dollars of legal immunity, why shouldn’t homeowners get that much debt forgiveness? Or, half that much? A quarter?"

Democratic state attorneys general and Obama administration officials met on Monday in Chicago to discuss the terms of the settlement. An announcement on the deal is expected any day.

President Obama last night:

New York Attorney General Eric Schneiderman will co-chair the unit along with officials from the Department of Justice, Securities and Exchange Commission and Internal Revenue Service.

New York Attorney General Eric Schneiderman

New York Attorney General Eric Schneiderman

Add to Your Blogger Account

Put it On Facebook

Tweet this post

Print it from your printer

Email and a collection of other outlets

Try even more services

In last night's State of the Union speech President Obama announced the creation of a committee to investigate "the abusive lending and packaging of risky mortgages."

All across the US, Occupy protestors have been "reclaiming" foreclosed homes and boarded up properties in what some are calling a "tactical shift" in the movement which has targeted the inequality in the distribution of wealth in the US. The 'investigation' announcement came just as a bank-friendly 'settlement' is about to be announced by the state attorney generals. Reports of the settlement talks, the 'too-big-to-fail' banks -- Bank of America, Wells Fargo & Co, JPMorgan Chase & Co, Citigroup and Ally Financial Inc -- would provide $20 billion to $25 billion of 'relief' to homeowners in exchange for being exempted from lawsuits for improper foreclosures and abuses in mortgage loans.

All across the US, Occupy protestors have been "reclaiming" foreclosed homes and boarded up properties in what some are calling a "tactical shift" in the movement which has targeted the inequality in the distribution of wealth in the US. The 'investigation' announcement came just as a bank-friendly 'settlement' is about to be announced by the state attorney generals. Reports of the settlement talks, the 'too-big-to-fail' banks -- Bank of America, Wells Fargo & Co, JPMorgan Chase & Co, Citigroup and Ally Financial Inc -- would provide $20 billion to $25 billion of 'relief' to homeowners in exchange for being exempted from lawsuits for improper foreclosures and abuses in mortgage loans.The findings of the new 'investigation' would come after the settlement gives the banks a get-out-of-jail-free card.

Matt Taibbi wrote on the proposed settlement: "The current proposed deal is a huge giveaway to the banks, a major shafting to most of the investors, and would probably give homeowners either next to nothing or some cosmetic reward, i.e. a little bit of principal forgiveness, counseling, etc. If the Obama administration was serious about helping actual human beings through this settlement, then it would be fighting for homeowners to get the same bailout the banks would get. If the banks are getting a trillion or more dollars of legal immunity, why shouldn’t homeowners get that much debt forgiveness? Or, half that much? A quarter?"

Democratic state attorneys general and Obama administration officials met on Monday in Chicago to discuss the terms of the settlement. An announcement on the deal is expected any day.

President Obama last night:

"And tonight, I am asking my Attorney General to create a special unit of federal prosecutors and leading state attorneys general to expand our investigations into the abusive lending and packaging of risky mortgages that led to the housing crisis. This new unit will hold accountable those who broke the law, speed assistance to homeowners, and help turn the page on an era of recklessness that hurt so many Americans. "

* * *

Bloomberg News reports:Obama Will Create Unit to Investigate Mortgage Misconduct After Protests

President Barack Obama said he will create a mortgage crisis unit that includes federal and state officials to investigate wrongdoing by banks related to real estate lending. [...]

“This new unit will hold accountable those who broke the law, speed assistance to homeowners, and help turn the page on an era of recklessness that hurt so many Americans,” Obama said in the speech.

New York Attorney General Eric Schneiderman will co-chair the unit along with officials from the Department of Justice, Securities and Exchange Commission and Internal Revenue Service.

* * *

Yves Smith writes at nakedcapitalism:Is Schneiderman Selling Out? Joins Federal Committee That Looks Designed to Undermine AGs Against Mortgage Settlement Deal

[...] So get this: this is a committee that will “investigate.” The co-chair, Lanny Breuer, along with DoJ chief Eric Holder, hail from white shoe Washington law firm Covington & Burling, which has deep ties to the financial services industry. Even if they did not work directly for clients in the mortgage business, they come from a firm known for its deep political and regulatory connections (for instance: Gene Ludwig, the Covington partner I engaged for some complicated regulatory work when I was at Sumitomo Bank, later became head of the OCC). We’ve written at length on how the OCC is such a shameless tout for the banking industry that it cannot properly be called a regulator. Similarly, the SEC has been virtually absent from the mortgage beat, no doubt because its enforcement chief, Robert Khuzami, was general counsel to the fixed income department at Deutsche Bank. That area included the trading operation under Greg Lippmann who we have described as Patient Zero of so called mezz CDOs, or to the layperson, toxic mortgage paper that kept the subprime bubble going well beyond its sell date. And we don’t need to say much about the DoJ. It has been missing in action during this entire Administration.

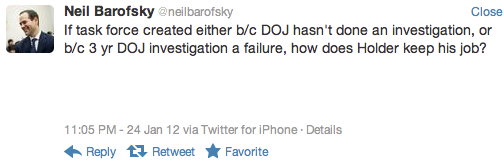

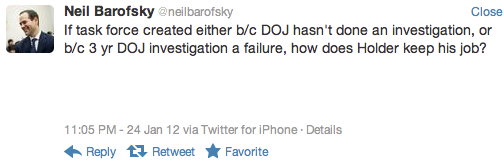

Neil Barofsky, former prosecutor and head of SIGTARP, doesn’t buy the logic of this committee either:

A lot of soi-disant liberal groups have fallen in line with Obama messaging, which was the plan (I already have the predictable congratulatory Move On e-mail in my inbox). Let’s get real. The wee problem is that this committee looks like yet another bit of theater for the Administration to pretend, yet again, that it is Doing Something, while scoring a twofer by getting Schneiderman, who has been a pretty effective opponent, hobbled.

If you wanted a real investigation, you get a real independent investigator, with a real budget and staffing, and turn him loose. [...]

Put it another way: one thing that would convince me that this committee was serious was if the settlement pact was put on hold until the investigation were completed. The fact that the settlement push is in high gear is yet more proof that this committee is yet another bit of regulatory/enforcement theater, just like the Foreclosure Task Force, or the servicer consent decrees (confirmed as an embarrassment via the use of badly conflicted “consultants”), or the current OCC investigation into foreclosure abuses, which excludes all sorts of injuries inflicted upon homeowners, most notably servicer fees abuses and misapplication of payments. [...]

It would be better if I were proven wrong, but this looks to be yet another clever Obama gambit to neutralize his opposition. With all the same key actors in place – Geithner, Walsh, Holder – there is no reason to believe the Administration has had a change of heart until there is compelling evidence otherwise.

* * *

Kai Wright writing at Colorlines: New York Attorney General Eric Schneiderman

New York Attorney General Eric SchneidermanThe question remains whether Schneiderman’s unit will be window dressing for a get-out-of-jail-free settlement with banks that are currently facing heat from state attorneys general over fraudulent foreclosures.

Here’s the reaction from the New Bottom Line, a relatively new coalition of homeowner advocates and community groups that had been making this very demand loudly for years:

President Obama has heard the calls of the 99% and announced a full, federal investigation into the fraudulent activities of big banks…. We will continue to make sure that this investigation uncovers the truth about the activities of the big banks. And in order to provide real and meaningful relief to millions of homeowners, the end result must be at least $300 billion in principal reduction and restitution for those who have lost their homes, especially targeted at the most hard hit communities. This will reset the housing market and the economy.

* * *

David Dayen at Firedoglake:The unit will be co-chaired by Eric Schneiderman, the New York Attorney General who bravely waged an often lonely battle to stop a misguided settlement on foreclosure fraud. But “co-chair” is the operative word here, and it suggests that the entire maneuver was created to grease the wheels for the pre-arranged settlement, while turning this investigatory arm into nothing so much as regulatory theater. [...]

This is a classic Obama move, putting a threat or a rival inside the tent. It happened with Elizabeth Warren and David Petraeus and Jon Huntsman, and it’s happening again. It divides the coalition against a weak settlement, which will at the least shut down state and federal prosecutions on foreclosure fraud and servicing issues. It puts hopes in yet another investigation, one with little chance for success... I’d really like to be wrong about this. But this just reads like a gambit, a fix, a charade.

Help Us Transmit This Story

Add to Your Blogger Account

Put it On Facebook

Tweet this post

Print it from your printer

Email and a collection of other outlets

Try even more services

No comments:

Post a Comment